While the rings break back external, the newest squeeze is regarded as “create,” and you can investors see directional impetus to enter the brand new change. You can also keep it simple and just pertain Bollinger Band squeezes, along with regularity verification, to identify bullish breakouts and bearish malfunctions. It $20 exchange assortment continued to possess household on end ahead of breaking down less than $65 in the a-sharp relocate late 2023. The newest Turtle Strategy signaled a great promote name if the stock drifted for the $340.

Display screen The brand new Trading

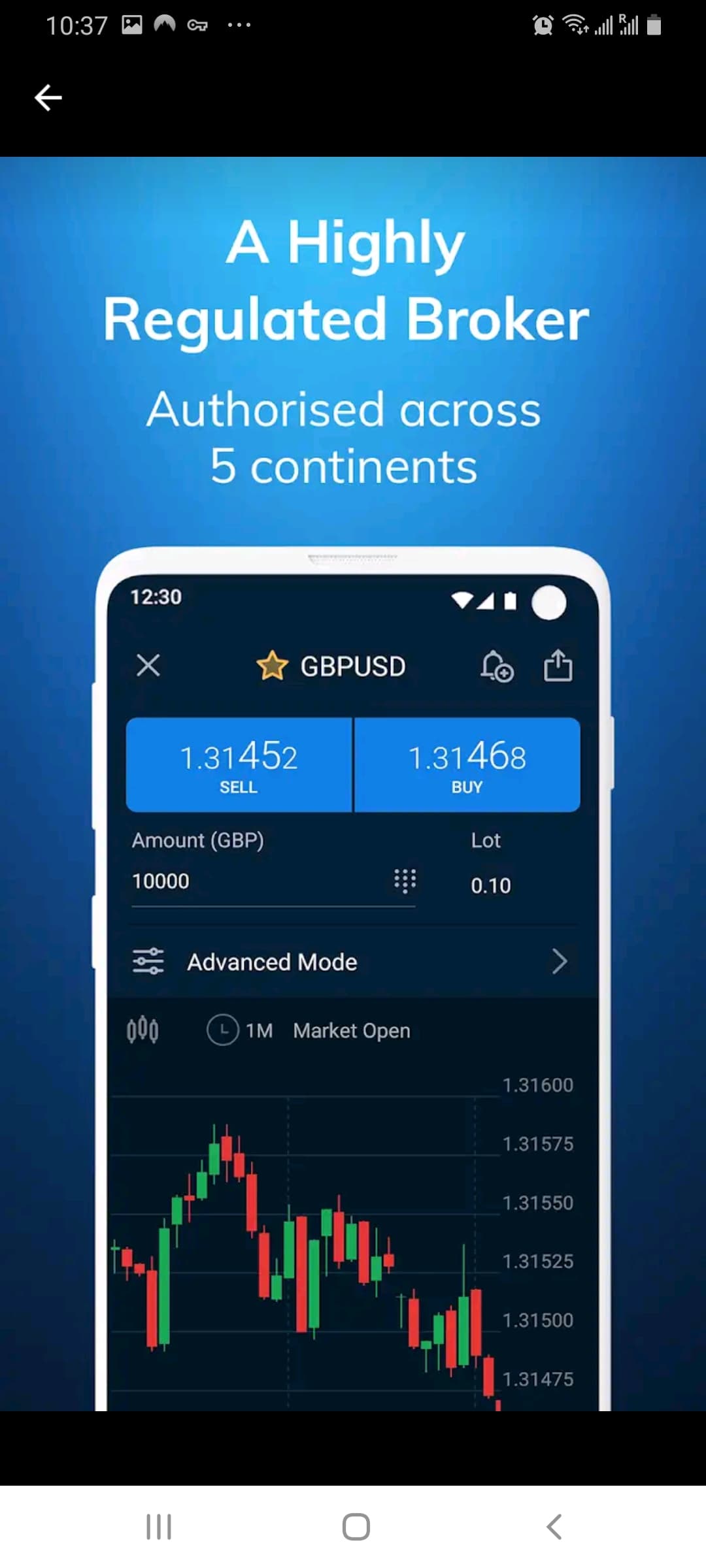

Swing trading are means of trading one to seeks to benefit from quick so you can medium-label price shifts, generally more than a duration of just one-4 weeks. The aim is to maximize profits by taking advantage of short term price movements while you are minimizing loss because of chance administration procedures. The fresh difference in swing exchange and you can date trading is usually the carrying going back to positions. Move trading tend to comes to at the very least an over night hold, whereas time investors close out ranks before business shuts. To help you generalize, date change positions is restricted to your day, when you are move trading comes to holding for several days in order to days. Move people attempt to get into positions during the key assistance and you will opposition account, with many deciding to hold back until the brand new reversal try started prior to typing a trade.

Dangers inside the swing change try consistent with market speculation generally. Threat of loss of swing exchange generally increases inside the a trading and investing range, or laterally rates course, compared to the a good bull business otherwise happen business that is certainly moving in a particular assistance. The brand new compound aftereffect of such reasonable however, frequent progress will likely be ample. Set and tend to forget trade is actually a structured means one to balances strategic thought having emotional discipline.

If the losses might be remaining so you can acceptable membership playing with end loss processes, move change will be effective and supply a great direction in order to know about both quick-name and long-term market actions. The newest downside from move exchange is you need to bust your tail for hours on end to cope with trades, you you are going to lose out on possible winnings because of market motions. Move trading now offers a heart-ground means between the https://pkforce.com/2025/05/16/google-%e0%a4%86%e0%a4%a8%e0%a4%82%e0%a4%a6-%e0%a4%aa%e0%a4%b0-%e0%a4%b5%e0%a5%8d%e0%a4%af%e0%a4%be%e0%a4%aa%e0%a4%be%e0%a4%b0-%e0%a4%85%e0%a4%b0%e0%a5%8d%e0%a4%a5%e0%a4%b6%e0%a4%be%e0%a4%b8%e0%a5%8d/ hyperactivity away from day trading and the high perseverance away from a lot of time-term investing. When done with disciplined exposure government, thoughtful technology study, and you may psychological handle, it does give more than-average productivity while you are accommodating performs and you can life obligations. But not, achievements requires nice expertise development, invited away from straight away carrying threats, plus the mental fortitude to maintain trade punishment because of inescapable field action.

Put Your targets

Just what separates winning move investors isn’t the number of configurations they are aware—it’s their capability to adhere to you to means, perform exposure continuously, and you can comply with altering industry conditions. Sample for each and every approach prior to going alive, explore obvious legislation to have entries and you will exits, and you may wear’t undervalue the worth of determination. People also can merely select biggest service and you may resistance profile and come across prospective reversals from the individuals accounts or breakouts as a result of them. Having service and you may resistance accounts, you will find an expectation that rates get jump from him or her, and also in case your rate is able to break through, that it will continue to followup in that direction.

- Move buyers can use the newest golden (the brand new reduced MA crosses over the prolonged MA) and you can demise mix (opposite for the golden cross) patterns to help you signal trend reversals.

- This plan works best in range-sure otherwise laterally places in which prices oscillate between obvious service and you may resistance membership.

- It’s perfect for people that is also’t display the charts all day but could dedicate an excellent a couple of hours taking a look at industry a night.

- If you are Put and tend to forget offers framework and you can abuse, it’s important to discover where it does are unsuccessful.

As well as instead of go out trading, which involves closure all of the ranks towards the end of the change day, swing trade lets ranks to stay unlock right away, taking advantage of trend you to take care to produce. Swing Exchange will bring a functional and you may balanced method of trading, therefore it is a practical option for of several buyers. They bridges brief-term and you may enough time-label steps, permitting traders when deciding to take advantageous asset of business shifts without the need for lingering market monitoring.

They likewise have well-discussed goals to the change, often trying to exit before or simply just while the disperse finishes. Although swing people target volatile carries with broad rates activity, anybody else like stocks with increased stable style. Move change are a trading method which involves carrying ranks to have a short while to many days, aiming to profit from brief- to help you typical-term field manner. It will take persistence, abuse, and you will a powerful comprehension of the newest segments. Swing trading try an initial- to medium-identity trade strategy you to definitely tries to make the most of rates shifts inside an inventory and other monetary resource. People whom use the move trade method analysis speed charts and you may have fun with other designs from tech investigation and then make its choices.

Swing trade offers an adaptable way to sit mixed up in segments without getting glued to the display screen for hours on end. If your’re trade breakouts, pullbacks, otherwise pre-stimulant actions, the key is to find a technique that suits their chance threshold, plan, and psychology. Product buyer Richard Dennis instructed the fresh turtle method regarding the 80s. The concept is to find breakouts and you may exit the career whenever cost beginning to combine at the a premier area otherwise start to refuse.

On this page, we’ll bring a deep diving to your move trade, layer tips, an informed signs to make use of, and. If you are victory costs vary, educated move buyers normally go for a victory price out of fifty-60%. However, proper exposure administration ensures that successful deals are more successful than simply losing of these, causing full self-confident production. Using this type of swing trading method, an escape rule came up if relative strength index RSI achieved high overbought readings signaling a potential pattern reversal. This method normally now offers superior exposure-award pages compared to the pure trend following the, as the entries exist nearer to assistance or opposition membership, making it possible for firmer stop location.